Matthew Jaster, Senior Editor, PTE

The article "Electrification Reimagined" appeared in the April 2021 issue of Power Transmission Engineering.

It’s difficult to keep up with all the electric trends, technologies and forecasts taking place across the transportation sector. What we do know is digital transformation is leading the way.

There’s always new data available in areas like battery technology, energy efficiency, autonomous vehicles and hybrids. Thankfully, this editor has been sealed air-tight in his upstairs office for 8+ months now — courtesy of the pandemic — creating a unique opportunity to attend as many virtual automotive and manufacturing events as possible. The following is a cheat sheet on E-Mobility, electrification, and the push toward a digital future.

Digital, Informative, Interactive

At last year’s CTI Symposium USA, electrification and E-Mobility presentations examined everything from legislation issues to fuel cells and hybrid trends.

Patrick Lindemann, president, transmission systems and E-Mobility at Schaeffler Group USA described automotive technology like a ketchup bottle, ‘sometimes it may come out a little at a time or come out on the plate all at once.’

Patrick Lindemann, president, transmission systems and E-Mobility at Schaeffler Group USA described automotive technology like a ketchup bottle, ‘sometimes it may come out a little at a time or come out on the plate all at once.’When CTI interviewed Chairman Dr. Hamid Vahabzadeh, strategy advisor, AVL List GmbH, he was asked to explain how OEMs’ product lines will need to change to meet net-zero-emissions targets, he said electrification is the name of the game and the end game seems to be the battery electric vehicle technology.

“While many companies have developed and produced a wide variety of electrified drivetrains for their hybrid electric vehicles leveraging their existing ICE based platforms, they are actively developing pure battery electric vehicles to achieve the net-zero emission target. One of the most difficult applications to tackle is the light- and medium-duty truck applications due to their payload and towing requirements, and yet, most OEMs have announced production plans for such vehicles. This shows the wide spectrum and scalability of the technology,” Vahabzadeh said.

The underlying theme of the event was the systematic approach needed to create integrated solutions for the electric motor, the inverter and the gearbox. Product development is a huge challenge thanks to the variety of solutions and technologies available for E-Drives.

E-Strategies from Automotive Manufacturers

General Motors

During a Washington Post Virtual Conference in March, GM President Mark Reuss announced a joint development agreement with SolidEnergy Systems (SES) and gave the public some details on its next-generation Ultium battery chemistry.

“Affordability and range are two major barriers to mass EV adoption,” said Reuss. “With this next-generation Ultium chemistry, we believe we’re on the cusp of a once-in-a-generation improvement in energy density and cost. There’s even more room to improve in both categories, and we intend to innovate faster than any other company in this space.”

The expected battery energy density increase could enable higher range in a similarly sized pack or comparable range in a smaller pack. The weight and space savings from smaller battery packs could help with vehicle lightweighting or create more room for additional technology.

Part of the foundation of GM and SES’ collaboration on Li-Metal prototype batteries is GM’s extensive lithium metal battery experience. The company’s expertise in this field has resulted in 49 patents granted and 45 patents pending. SES will also bring its own lithium metal intellectual property to the collaboration.

GM announced this rapid technical progress for possible use in future Ultium-based vehicles just one year after the reveal of the first-generation Ultium Platform. The first Ultium-based products are expected to go on sale later in 2021.

Additional announcements on GM’s zero-emissions future included:

GM revealed a modular propulsion system and highly flexible global EV platform powered by proprietary Ultium batteries.

GM committed more than $27 billion to EV and AV product development and plans to launch 30 EVs globally by the end of 2025, with more than two-thirds available in North America. Cadillac, GMC, Chevrolet and Buick will all be represented, with EVs at all price points for work, adventure, performance and family use.

In January 2021, GM unveiled BrightDrop, a new business that aims to electrify and improve the delivery of goods and services by offering an ecosystem of electric first-to-last-mile products, software and services to help empower delivery and logistics companies to move goods more efficiently.

GM’s zero-emissions technology will extend to fuel cells, and the company announced it will supply its Hydrotec fuel cell power cubes to Navistar for use in its production model fuel cell electric vehicle — the International RHTMTM Series.

GM is investing $2 billion to transition the Spring Hill, Tennessee plant to build EVs, including Cadillac LYRIQ.

GM announced that the Detroit-Hamtramck assembly plant, named Factory ZERO, will be GM’s first plant that is 100 percent devoted to electric vehicles and in fall 2021, will start building the new GMC Hummer EV.

In 2019, GM announced the formation of Ultium Cells LLC, a joint venture with LG Chem to mass-produce battery cells in Ohio for future battery-electric vehicles. Construction is currently underway at the facility.

Ford Motor Company

Ford ended 2020 strongly, improving its automotive and credit businesses in the fourth quarter while showing and shipping new vehicles designed to delight customers, expand profitability, and sustain free cash flow.

“The transformation of Ford is happening and so is our leadership of the EV revolution and development of autonomous driving,” said Ford President and CEO Jim Farley. “We’re now allocating a combined $29 billion in capital and tremendous talent to these two areas, and bringing customers high-volume, connected electric SUVs, commercial vans and pickup trucks.”

Customers in the U.S. in the fourth quarter began taking delivery of the all-electric Mustang Mach-E; the Bronco Sport, ahead of the summer return of the legendary Bronco; and the 2021 F-150 pickup — all expected to be significant contributors to 2021 results.

With Ford Telematics, fleet operators can now gather, view and monitor data from all their vehicles, regardless of manufacturer. With this expanded functionality, fleet managers will be able to analyze all of their fleet vehicles in one easy to use dashboard– including the ability to improve uptime, monitor performance and plan maintenance services.

Customers can leverage this capability on most non-Ford vehicles by using a plug-in device that connects to each vehicle with a wiring harness that leaves the OBD II port available for use.

Additionally, this expanded functionality is provided as part of the regular subscription cost for Ford Telematics.

The ability to support all makes and models is just the latest step Ford has taken to expand the breadth of Ford Telematics. Fleet customers who deploy electric vehicles also have access to an electric vehicle telematics dashboard, which provides features such as electric-vehicle data, charging reports, and web-based pre-conditioning that can help optimize battery efficiency.

In addition, Ford is moving to make its services even more accessible with the launch of Ford Telematics Essentials for Ford vehicles, a complimentary level of service for commercial customers that will be available beginning in the second quarter of 2021.

Ford Telematics Essentials gives customers access to vehicle health insights such as odometer readings, diagnostic trouble code and information around oil life, engine hours and recalls. Later this year, this complimentary service will also allow fleets to digitally track and plan maintenance or repair services with local dealers.

E-Strategies from Component Manufacturers

Meanwhile, organizations looking to develop electric technologies continue to join forces to bring new electric components to market.

LG Electronics and Magna International Inc., for example, announced a joint venture to manufacture e-motors, inverters and on-board chargers and, for certain automakers, related e-drive systems to support the growing global shift toward vehicle electrification. This enables the two companies to continue to grow their electric powertrain product offerings by leveraging existing technologies, engineering capabilities and global footprints. The market for e-motors, inverters and electric drive systems is expected to have significant growth between now and 2030.

LG has established experience in the development of electric vehicle components most notably for the Chevrolet Bolt EV and Jaguar I-PACE. LG will help accelerate Magna’s time to market and scale of manufacturing for electrification components, while software and systems integration are competencies that Magna brings to this venture. This JV will allow customers to select from a portfolio of reliable components through to integration of an entire electrified powertrain.

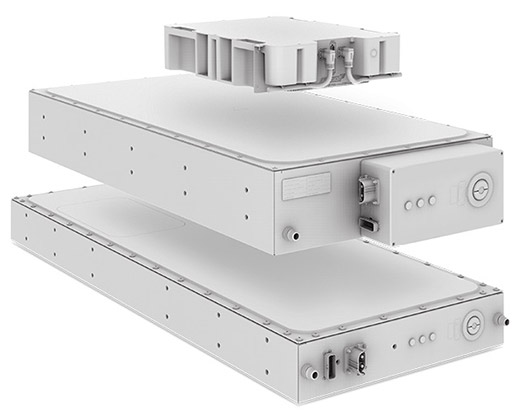

Additionally, BorgWarner recently signed a business combination agreement with Akasol AG to position BorgWarner to significantly expand its commercial vehicle electrification capabilities.

Headquartered in Darmstadt, Germany, Akasol AG designs and manufactures customizable battery packs for use in buses, commercial vehicles, rail vehicles and industrial vehicles, as well as in ships and boats. This proprietary system technology is cell-agnostic, providing a low-cost, flexible solution to world-class customers. With more than 300 full-time employees and three facilities across Germany and one facility in the United States, Akasol believes it is well positioned to capitalize on the large market opportunity across Europe and North America.

“Akasol is an excellent strategic fit as BorgWarner seeks to continue to expand its electrification portfolio and capitalize on the profound industry shift towards electrification. Akasol’s manufacturing footprint and established, in-production customer base are complementary to BorgWarner’s and would accelerate our foothold into the fast-growing commercial vehicle and off-highway battery pack market,” said Frédéric Lissalde, president and CEO of BorgWarner.

“Akasol is highly-regarded as a reputable and reliable partner, and like us, they have a customer-first mentality and a culture of innovation and environmentally friendly technology leadership. We look forward to welcoming their incredibly talented team to BorgWarner.”

BorgWarner believes the acquisition would significantly strengthen its commercial vehicle and off-highway battery systems business as it continues to execute its electrification strategy. With the global, lithium-ion battery market for electric vehicles expected to grow, Akasol believes it is well positioned to meet the demand for battery systems in the global electric commercial vehicle market.

“The executive board welcomes the strategic partnership with BorgWarner, as it offers significant strategic perspectives to Akasol,” said Sven Schulz, CEO and founder of Akasol. “BorgWarner shares our vision of emission-free mobility, and with joint forces, we will expand Akasol’s technology and market leadership for high-performance battery systems.”

GKN and Tata Technologies is joining forces to establish an e-mobility software engineering center in India.

GKN Automotive is strengthening its eDrive technology leadership as 13 more electrified models from 10 leading global brands enter the market, powered by its world leading systems.

The new platforms span four major global automotive manufacturers and range from premium four-wheel drive SUVs to an iconic electric city car.

The innovative technologies on these models include GKN Automotive’s world class compact and efficient three in one eDrive systems. These systems bring together leading-edge advances in electric motors, transmission, traction inverters, software and controls.

This major milestone comes just one year after the announcement that GKN Automotive has over one million eAxles on the road and is the result of collaboration with the world’s leading automotive manufacturers to fully integrate advanced eDrive systems into electric and hybrid cars.

“This is further evidence that our investment, innovation and expertise in world-leading eDrive technologies is paying off. Our ambitious plans for eDrive will ensure GKN Automotive plays a leading role in driving the world’s electrified future,” said Dirk Kesselgruber, president ePowertrain, GKN Automotive.

“Our customers are already benefitting from the efficiencies and innovations that GKN Automotive eDrive systems bring and we intend to keep innovating for even better performance,” he added.

Oliver Jones, vice president business development ePowertrain summed it up best, “It’s exciting to see more of our innovative eDrive technologies on the road. We’re accelerating our work to bring our advanced, compact and efficient electric drive systems to market on even more vehicles.”

Mary Ellen Doran, Director of Emerging Technology, AGMA

AGMA Electric Drive Committee Discusses xEV Technology

The AGMA Electric Drive Committee met more than a dozen times in 2020 to discuss new technology.

With each meeting the committee grew in membership and information gathered. It ended the year with almost 40 participants from major OEMs, gear manufacturers, machine tool manufacturers, and suppliers to the industry — all keenly interested in the movement to hybrid and electric vehicles.

Committee Chair, Michael Cinquemani, president and CEO of Master Power Transmission, Inc. worked with committee members to take the culmination of these discussions and create a document for the AGMA membership. The white paper that is being released by the committee in April, 2021. This document provides a gearing-centric snapshot of the current automobile and truck technology shift, with the focus on the gear. This paper is the Committee’s commitment to fulfill the emerging technology goal to “Identify, investigate and inform AGMA members of Emerging Technologies that may disrupt or significantly impact the power transmission industry.”

The paper is divided into three sections:

Part One provides the big picture information on economics, policy and regulations, and recent research projects specific to this space. It includes some history of electrification for context but then discusses what we should watch for in the future. It includes current car sales and then goes into some details on the evolution and importance of consumers in this space. There has been a fundamental shift from early adopters who took advantage of early incentives and had a “green” ideology to those that choose to drive a Tesla because of the sheer performance of the vehicle. The section then lists some of the many policies and regulations from around the globe that are driving a reduction on carbon emissions.

Part Two is where the committee talks gearing. There is a profound reduction in the number of gears that are produced for an internal combustion engine versus the number of gears in an electrified driveline. The committee has worked to gather information on the diversity in drivetrain designs and provide information on the nuances to technology in this space. Both automotive and truck are discussed in detail as is the quest for the silent drivetrain. And the committee has provided comment on machine tool and heat treatment for this sector. This section also works to provide some clarity to important questions specific to the gear industry — How will gear manufacturing be impacted by the vehicle technology shifts? Will gear production be outsourced by OEMs? and more.

Part Three gives examples of bleeding-edge technologies that are not yet in mainstream that could be profound disruptors if the technology bears out. It also looks at new concepts for batteries and new ideas like Transportation-as-a-Service (TaaS).

The paper hopes to provide information to the AGMA membership on gears in this space.

We have worked to answer some of the more important questions that have come up in discussions about the switch to electric drivetrains. We understand that vehicle manufacturers will experience a period of flux where they will be working to make both internal combustion and multiple electric drivelines simultaneously. And one important question to which they found some clarity was — Who will make the gears? The Committee has found that while there has been outreach for gear prototypes and overflow the large, established OEMs are keeping gears in-house, for now. One comment from a committee member was, “those that do it today at volume will do it tomorrow.”

One other big area of discussion is a new problem for gear manufacturers — regenerative braking. In addition to the production of more torque, regenerative braking requires performance on both flanks of the gear. This has resulted in the need for higher precision and durability on the gears. The paper discusses this issue with detail.

There will be a full list of committee members in the paper, but I would like to personally thank each one of them for their time and thoughtful participation to work together to lift the entire industry in this emerging space.

As with all four AGMA Emerging Technology Co-mmittees, Electric Drive Committee participation is open to any individual that works for a member company and to those outside the membership who can directly contribute to the collaborative discussion. I urge you to become more familiar with the emerging technology activities of AGMA. We have a new webinar series the first Wednesday of each month. Check out our website that contains a list of committee meeting dates, articles of interest, videos of the week, and more information on how you access this paper when it is ready.

Mary Ellen Doran

Director of Emerging Technology, AGMA

Mary Ellen Doran has been working at AGMA for ten years. In 2018, she moved into the new role of Director, Emerging Technology. Through this role, she developed a new area of work for the association. Now, she and the committee members are able to provide actionable information to gear manufacturers on technologies that may be of importance to their future, or may disrupt their future. The goal of the Emerging Technology Committees is to: “identify, investigate, and inform AGMA members of emerging technologies that may disrupt or significantly impact the gear manufacturing industry.” Mary Ellen leads the four emerging technology committees: 3D metal printing/New materials; Electric drive technology; Robotics and automation; and Industrial IoT. Prior to her emerging tech position, she worked in the communications department developing the website, electronic newsletters, and marketing pieces for AGMA. She holds a Bachelor’s of Fine Art in graphic design from The Ohio University.